How to Streamline Your Business Processes

Several times in this blog I’ve talked about the need to simplify business processes. In June I discussed how to Speed Process Validation with Limited OQ. Here’s an example from a completely different business. The applications of this company’s innovation to regulatory processes are many.

Several times in this blog I’ve talked about the need to simplify business processes. In June I discussed how to Speed Process Validation with Limited OQ. Here’s an example from a completely different business. The applications of this company’s innovation to regulatory processes are many.

In the early 90’s a company located in northern Ohio had a problem. Their business was selling insurance to high risk drivers, motorcyclists, people with DUI convictions. They were very small compared to the competition in an advertising intensive business. They knew that they had to grow or die.

They surveyed their customers to find out what they could do to increase market share. Their survey showed that cash flow was important to their customers. Most of them were living paycheck to paycheck and quick turnaround after a crash was critical.

Immediately the company embarked on a program to speed up reimbursement payments. That program basically consisted to telling the processors to hurry up. Of course, when the processors simply rushed through the existing process, they made errors.

The errors both slowed down the payment process and caused a great deal of customer dissatisfaction; neither of which helped the company to realize their growth goal.

Now they decided that they needed to look deep into their reimbursement procedures, if they were going to have any hope of cutting average payment time.

They found that:

- the process of estimating, approving, and paying for auto accident damage was complex, costly, and took too long.

- 90% of the claims were simple.

What had happened is that the company had built up their reimbursement procedures layer by layer over the years. Each time they found a problem, they had done their due diligence, found the root cause, and then installed a revised process that was designed to prevent that problem from occurring ever again.

They had made the right moves on each occasion to correct errors. Added up over the long haul, however, the totality of those decisions had landed them in the wrong spot. Because their processes were complex, they needed experienced, well paid employees to handle all of their cases.

The obvious fixes, hiring more people, and motivational programs to incentivize speed were not going to work. The company had to step back and look at their business processes in a new way. Their solution was to use their newfound knowledge to construct new business processes.

Since 90% of the claims were simple, they trained all of their adjustors in the simple cases and allowed them to settle claims on the spot. The adjustors were empowered to make a decision and write a check immediately for the simple claims. This made their customers very happy.

The difficult claims were routed to experienced processors who pulled in specialists as necessary to insure the claims were processed correctly. The key to the changeover was the installation of a robust gatekeeper system to shunt the difficult claims into the more intensive process.

The new business processes were far simpler on average, involving fewer hand-offs. The new business processes allowed shorter, cheaper, and higher quality claim reimbursements.

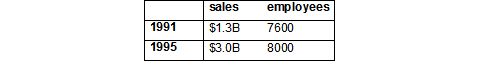

Here are the company’s sales and employee counts before and after the new business processes were implemented:

That company was Progressive Insurance. I’ll let you decide how successful the changes were.

This re-organization of a business process can readily be applied to any number of regulatory procedures, OOS results, deviations, non-conformances, and CAPAs to name a few.

Add new comment